In the dynamic financial sector, reliable communication forms the backbone of successful transactions and operations. Financial institutions depend heavily on voice communication to facilitate critical transactions, build client relationships, and ensure smooth internal coordination. According to a McKinsey report, communication breakdowns can result in a 20% decline in client satisfaction—particularly during high-priority interactions. For high-stakes transactions and VIP clients, ensuring impeccable communication quality is not just a priority; it is an absolute necessity. Let’s see what a deep voice quality analysis for financial institutions can do.

The High-Stakes Importance of VIP Communication Quality

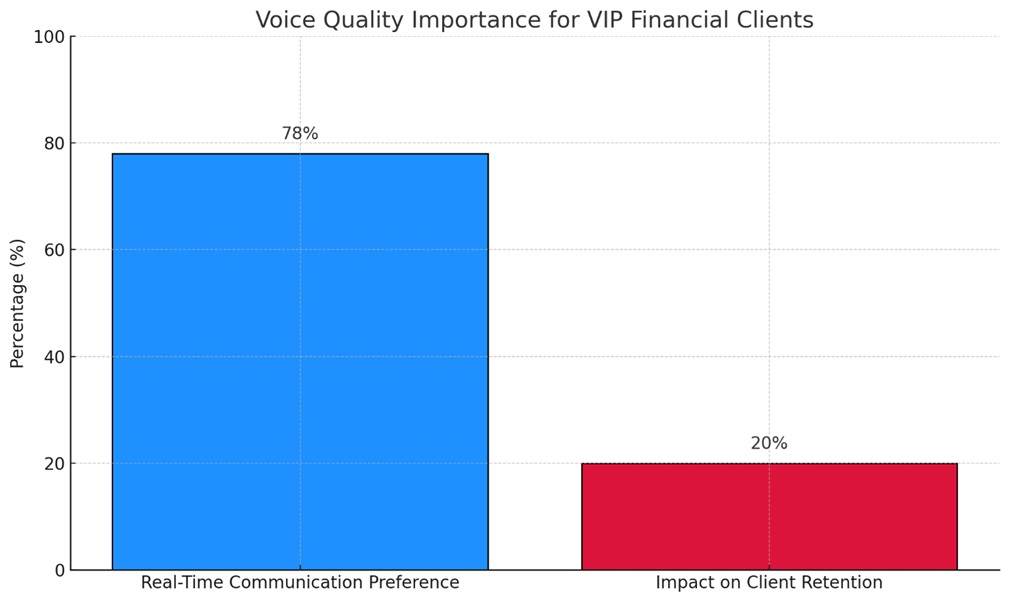

VIP communications, in particular, demand the highest levels of quality. A recent survey by Deloitte revealed that 78% of high-net-worth individuals prefer real-time voice communication for sensitive financial discussions, underscoring the importance of robust communication systems. Traditional voice quality analysis methods, which focus on metrics like jitter, latency, and packet loss, often fall short in meeting the elevated requirements of such high-stakes conversations. While these metrics provide essential insights into network performance, they may overlook subtle quality issues that can significantly impact the client experience.

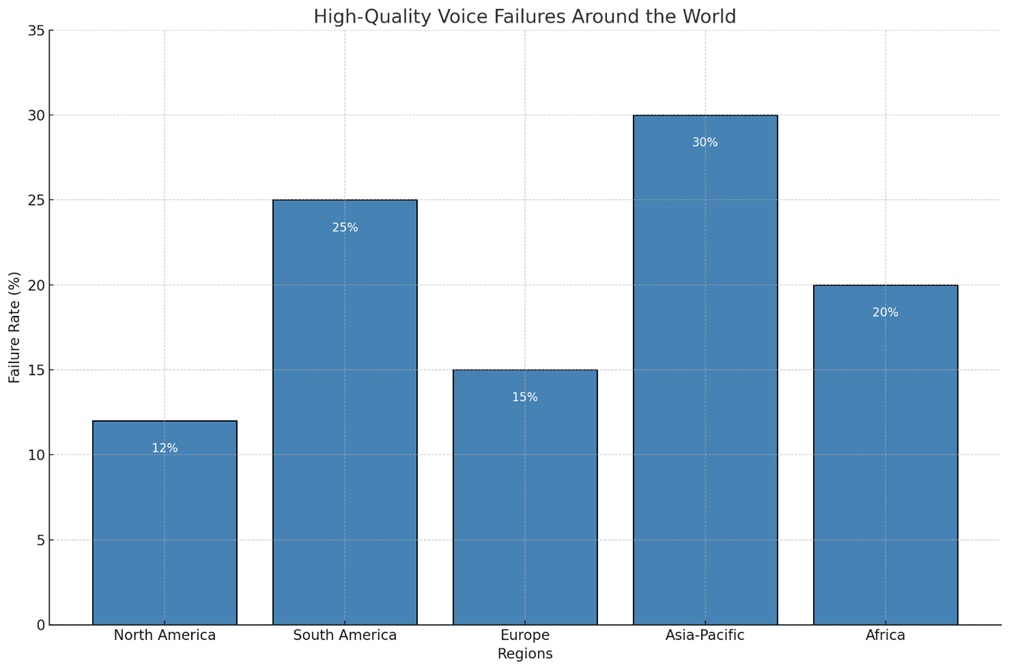

This infographic illustrates the significance of high-quality voice communication in the financial sector, highlighting how communication failures impact client satisfaction, VIP client preferences for real-time voice communication, and the unique global challenges in network performance.

Global Network Challenges in Financial Services

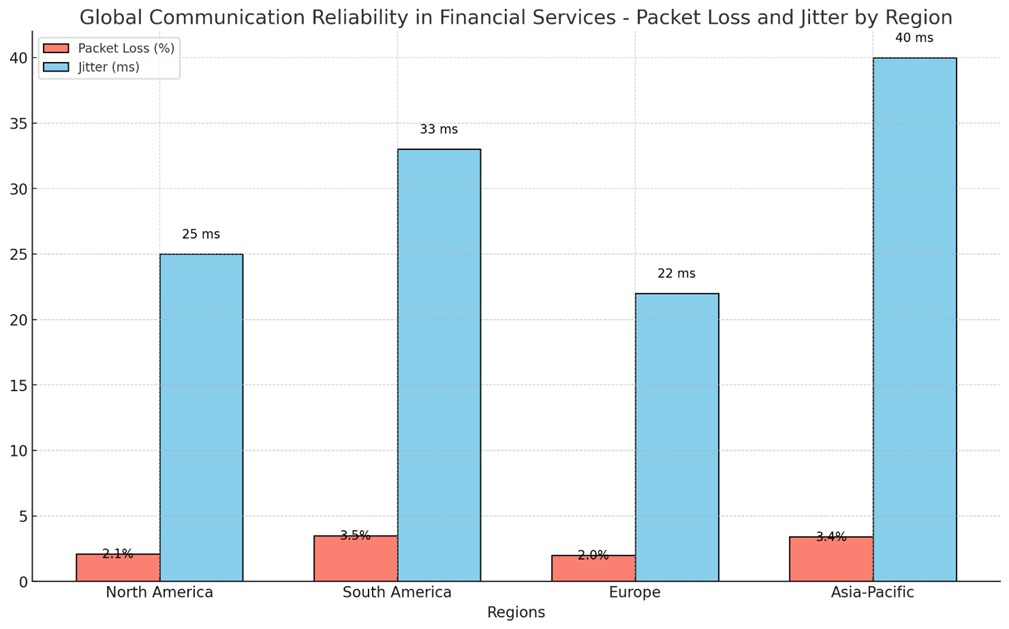

The global communication landscape reveals a pressing need for more comprehensive voice quality solutions. Network performance statistics vary widely, with North America experiencing an average packet loss rate of 2.1%, while Asia-Pacific reports slightly higher rates of up to 3.4% during peak hours (Source: Statista, 2022). Meanwhile, the shift toward digital banking and remote work has driven a 35% increase in voice communication for high-stakes transactions since 2020 (Source: PwC), adding further strain to communication infrastructures worldwide.

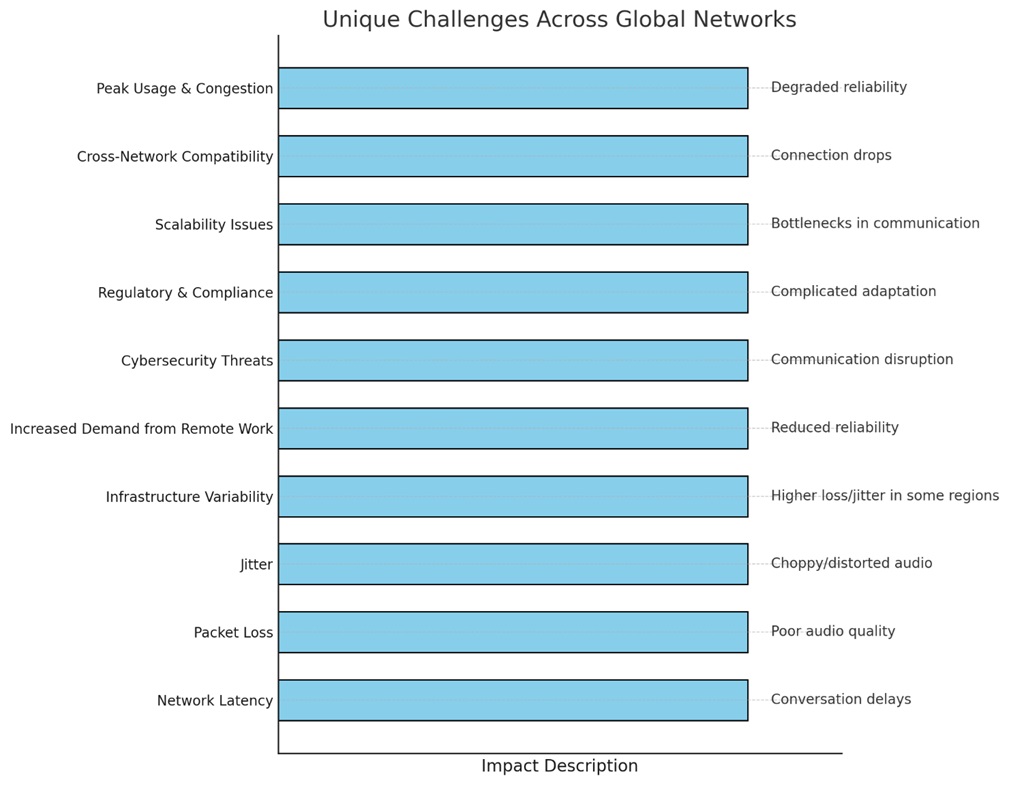

The chart summarizes the unique challenges institutions face across global networks. Each bar represents a challenge, with its corresponding impact described alongside. This visualization highlights the key issues affecting communication reliability and quality.

The Sevana Solution: Deep Voice Quality Analysis

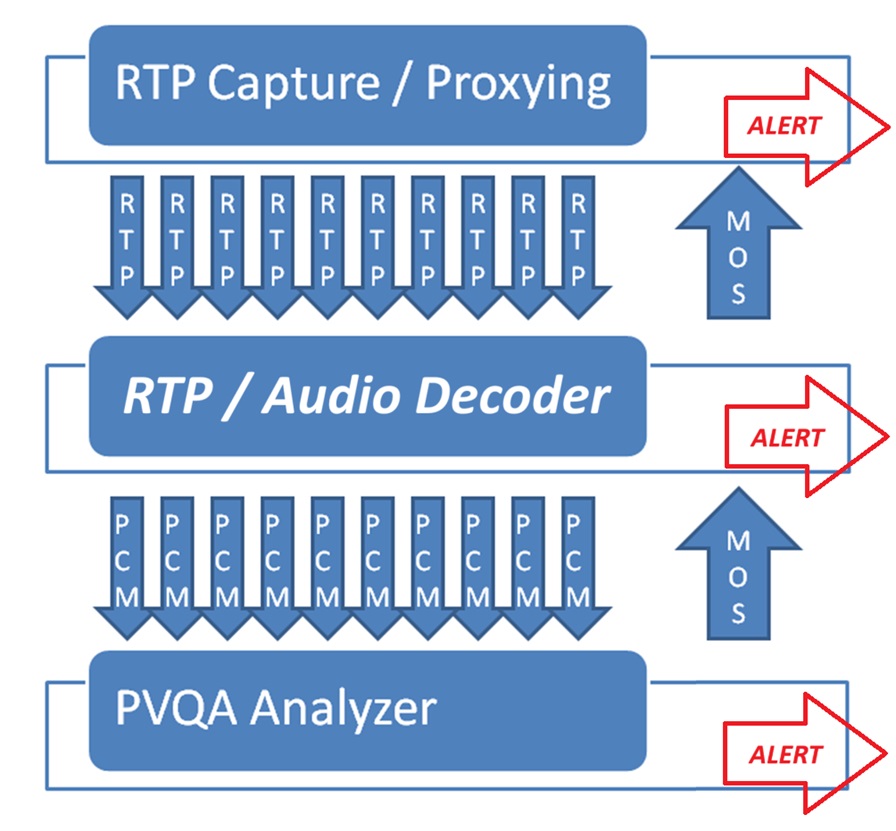

To secure the quality of these vital, high-importance communications, financial institutions need to go beyond standard analysis techniques. Sevana offers a transformative solution: deep voice quality analysis. Unlike traditional monitoring systems, Sevana’s approach includes comprehensive call payload analysis—a feature that moves beyond standard metrics to detect nuanced quality issues. This advanced analysis capability can identify quality impairments that might slip through traditional monitoring, which typically focuses only on jitter, latency, and packet loss.

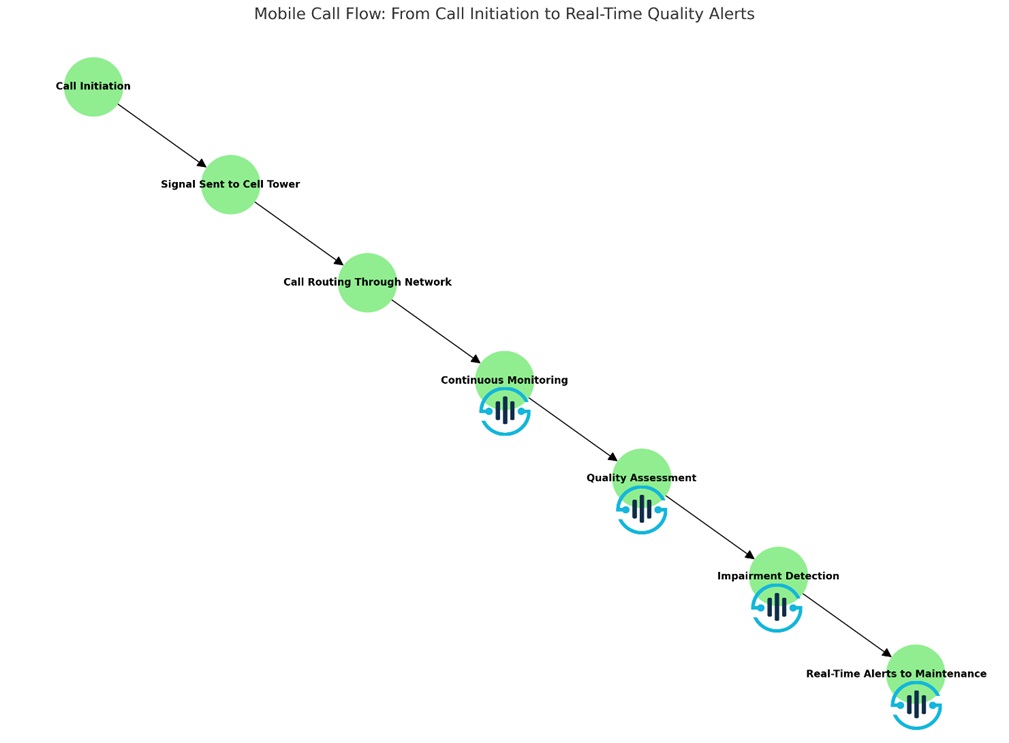

In addition, Sevana’s technology is designed to notify maintenance teams in real-time, providing early alerts for any quality issues that arise during a call. This proactive notification system is invaluable for ensuring uninterrupted, high-quality communications for VIP and high-priority calls, delivering critical support to high-stakes financial interactions.

Diagram of Sevana Deep Voice Quality Analysis: This diagram shows the difference between traditional metrics (jitter, latency, packet loss) at the RTP Capture level and Sevana’s comprehensive call payload analysis, highlighting the additional layers of alerting, protection and reliability.

Global Map of Communication Reliability in Financial Services: A heatmap displays packet loss, and latency rates across different regions, emphasizing the unique challenges each region faces and illustrating why advanced solutions like Sevana’s are essential in a global landscape.

Flowchart of Sevana’s Real-Time Alert System for Quality Monitoring: This flowchart demonstrates how Sevana’s solution operates—from call initiation and continuous monitoring to quality assessment and real-time alerts sent to maintenance teams.

Infographic on Voice Quality Importance for VIP Financial Clients

A quick-reference infographic summarizes key points, including VIP client preferences for real-time voice communication and statistics on how communication quality affects client retention. This infographic illustrates the direct benefits of Sevana’s deep voice quality analysis in supporting VIP communication needs.

Elevating Communication Standards for Financial Institutions

With Sevana’s deep voice quality analysis, financial institutions can elevate their communication standards, ensuring that every call, especially those of high importance, is delivered with reliability and clarity. By implementing Sevana’s solution, maintenance teams receive real-time alerts when quality issues are detected during a call, even when other systems might miss these nuances.

In a competitive landscape where trust and efficiency are paramount, Sevana’s solution helps financial institutions maintain their reputation for excellence in client communication, regardless of complex quality challenges. This solution not only addresses the demands of today’s high-stakes financial environment but also future-proofs institutions against evolving communication needs.

By combining robust data, advanced analysis technology, and real-time response capabilities, Sevana provides financial institutions with the tools to safeguard their most crucial communications. The result is a seamless client experience that supports both business continuity and long-term client relationships, enhancing the institution’s reputation for reliability in the global financial sector.